Blog

Federal Employers Beware: Increased Payouts on Termination Required as of February 1, 2024

January 23, 2024

Long awaited changes to the Canada Labour Code (CLC), brought on by the Budget Implementation Act, 2018, No. 2, are finally coming into effect on February 1, 2024. Most importantly, federally regulated employers will be required to pay employees significantly more on terminations without just cause.

Federally regulated employers should already be aware that terminations can only occur in limited circumstances because of restrictions in the CLC. Non-management (and non-unionized) employees with at least 12 months of service can only be dismissed for just cause, unless they are being terminated for lack of work or the discontinuance of a function (i.e., without just cause). These enhanced entitlements are only applicable where without cause terminations are allowed.

Termination obligations as of February 1, 2024

Federally regulated employees have always gotten the short end of the stick when it comes to termination entitlements, only two weeks’ notice or pay (and severance pay). As of February 1, 2024, employers will need to pay more on a without cause termination, similar to provincial termination requirements.

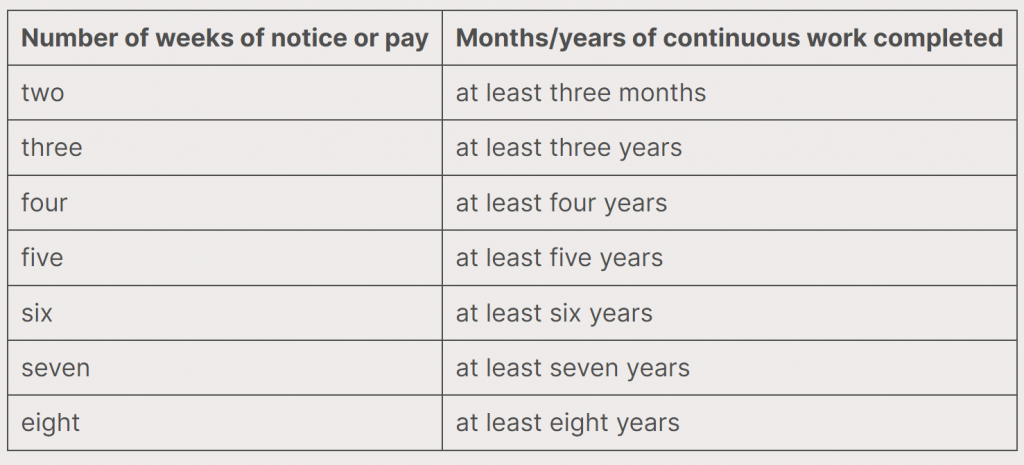

Federally regulated employees will be entitled the following notice and/or pay instead of notice:

Employers will also need to give terminated employees a statement of benefits at the time of termination that details their wages, vacation pay, severance pay, and any other benefits or pay received during their employment. This is a new requirement for individual terminations but has existed for group terminations of 50 or more employees.

No changes have been made to severance entitlements under the CLC. As a reminder, in addition to statutory termination entitlements, employees who have worked for at least one year are also entitled to severance pay. This is two days of wages per year for each completed year of service, with a minimum of five days of wages.

Reasonable notice at common law or pay instead of reasonable notice may still apply, in addition to these amounts.

Employer takeaways

Because of these changes, we recommend reviewing your employment agreement templates, collective agreements and workplace policies to ensure a smooth transition for your organization. We also suggest updating managers and human resource professionals so they can more easily answer employee questions. Please reach out to our firm if you have any questions about the impact of these changes on your business, and to review your employment contracts, collective agreements and workplace policies.